Common Cents, Uncommon Returns: The Little Book of Common Sense Investing Summary

Readers like you help support Lifespectrum360.com. When you purchase using links on our site, we may earn an affiliate commission. Read More.

Introduction

”The Little Book Of Common Sense Investing” is another must-have investment classic ( apart from “The Intelligent Investor Audiobook” in your library whether you are new or a professional investor. Read our The Little Book Of Common Sense Investing summary to find out the reasons why it made an entry into our next gen personal finance solution suite.

This book forces you to look at the stock market investment from a long-term perspective. Today, investors receive monumental volumes of statistical data from Wall Street. They do not know how to react to so much information.

Wall Street shows the urgency to act, and Investors don’t know what to do!! “The Little Book Of Common Sense Investing” clearly tells investors to ignore the “noise” in Wall Street and focus on the long term.

Here are the important lessons as part of The Little Book Of Common Sense Investing Summary –

- Build a well-diversified low-cost portfolio without the risks of owning individual stocks, manager selection, or sector rotation.

- Ignore the noise and focus on the real benefits of long-term investing.

- Remember that business reality will prevail over short-term market fluctuations.

- Successful investing is a marathon, not a sprint.

- Focus on harnessing the magic of compounding returns and avoiding the pain of compounding costs.

The Little Book Of Common Sense Investing Summary

about the author

The author of this book is JOHN C. BOGLE (also popularly known as Jack Bogle), who founded Vanguard (an asset management firm with around 8 trillion of assets under management (AUM), more than the size of the economies of several countries put together) in 1974. The visionary investor launched the world’s first index fund, “The Vanguard 500 Index Fund” and is credited as the “Father of Index Investing”. The Little Book Of Common Sense Investing is his best book, and John Bogle has tried to pen his entire life experiences in this book.

Warren Buffet mentioned: – “Rather than listen to the siren songs from investment managers, investors large and small should instead read Jack Bogle’s The Little Book of Common Sense Investing.”

Buffet said, “If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle. For decades, Jack has urged investors to invest in ultra-low-cost index funds. Today, however, he has the satisfaction of knowing that he helped millions of investors realize far better returns on their savings than they otherwise would have earned. He is a hero to them and me.”

You will find why this book should be in your library in The Little Book Of Common Sense Investing Summary, and how the “quotes” inside the book can help you in your next gen personal finance journey.

Here are the important chapters in The Little Book Of Common Sense Investing Summary, that you should never miss.

introduction

Like “The Intelligent Investor Audiobook“, The Little Book Of Common Sense Investing also has a powerful introduction chapter. You will find quotes on almost every page of this chapter. As an investor, you should never miss this chapter. In this summary, we will quote a few famous quotes. However, you can get a copy on Amazon and read it once if you are looking for financial freedom.

The introduction starts with a quote, “Don’t allow a winner’s game to become a loser’s game”. John Bogle believes everyone can be a winner if they hold their fair share of the nation’s businesses at a meager cost.

If the stock market represents the nation’s economic activity, investors can have a fair share of the nation’s business through the stock market route. However, there are two challenges to it.

First, buying every stock as an individual investor is costly and sometimes impossible. For example, If one has to buy a Berkshire Hathaway company share, a single stock is worth over $ 550,000 as of date, which not ordinary investors can afford to buy. However, a fund that pools money from several investors can buy this stock, and by buying into such a fund, the investor indirectly benefits from the ownership of the stock.

Therefore, an investor’s fair share of the nation’s businesses can only be achieved by buying into a fund that holds an all-market portfolio. Investing in such an all-market fund also eliminates the risk of owning individual stocks, picking a particular sector, and manager selection.

The second challenge investors face is the transaction costs like brokerages, taxes, and other service charges. Each time you buy or sell a stock, Wall Street makes money, and that’s why Wall Street doesn’t encourage you to invest in index funds. Brokers, Investment managers, and advisors will try to convince you that fund X has performed exceedingly well with a Y% return last year(s), so you should move your money to fund X. However, what they don’t tell you is, how much brokerage and other service charges and taxes you will bear by doing such types of buying and selling.

This book shuts the door for such noises and only advises holding the index funds forever. John Bogle says, “Focus on the magic of compounding investment returns and avoid the tyranny of compounding costs.”

We could not miss including the introduction chapter in our The Little Book Of Common Sense Investing Summary because it sets a perfect tone for the rest of the chapters.

chapter - 4: how investors turn a winner's game into a loser's game

The next must-read chapter I recommend in The Little Book Of Common Sense Investing Summary is chapter – 4. This chapter starts with a quote, “The Relentless Rules Of Humble Arithmetic” because of its focus on harnessing the power of compounding.

When investors face challenges like individual stock, sector or manager selection, and stock liquidity, Wall Street proposes actively managed funds to investors. These funds do have experts, so-called fund managers to decide where to invest, how much to invest, when to invest, and exit from the stocks. Because of their expertise, they are supposed to give better returns than the broader stock market.

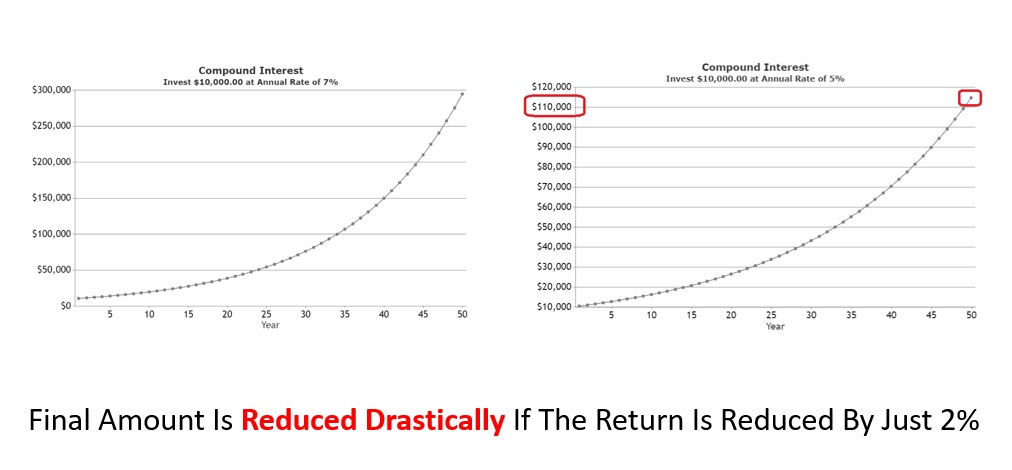

John Bogle busts this mythical superior returns. He explains the direct and indirect costs like sales fees, administrative expenses, transactional fees to churn the portfolio, and taxes that eat into the returns. He mentions that historically, this cost is roughly around 2-3% per year. i.e. if the fund earns 10% per year without those costs, your actual return would not be more than 7-8%.

He has taken an example of $10,000 invested by a person at the age of 18 years, which should have become $ 294,600 by the age of 68, considering an annualized return of 7%. However, if the return comes down to 5% because of the costs, the final amount will become only $ 114,700. That means a massive $179,900 has gone towards the hidden costs.

If these staggering statistics don’t open your eyes, what else will?

John Bogle makes the strongest pitch in favor of low-cost funds. by saying, ” Costs make the difference between investment success, and investment failure.” So watch out for the cost of funds while investing. I could not miss this chapter in “The Little Book Of Common Sense Investing Summary”.

chapter - 8: taxes are costs, too

This chapter starts with a quote, “Don’t pay Uncle Sam any more than you should.”

This chapter has many examples based on arithmetics. If you are not good at maths, don’t worry. Get a physical copy of the book from Amazon and read it, Or listen to The Little Book Of Common Sense Investing Audiobook multiple times. This chapter has a strong message to convey.

Let’s do some Maths:

From 1991 to 2016, In 25 years, the S&P 500 gave an annualized return of 9.1%, whereas the average mutual fund returned 7.8%. A good 1.3 % points per year less.

Then comes the TAX.

Since actively managed funds incur a high amount of buying and selling of stocks, their estimated effective annual federal tax is 1.2% or about 15% of the total pre-tax return. If you add state and local taxes, the number will balloon. (page – 88)

Result: The post-tax return of average actively managed funds reduces to just 6.6%.

On the other hand, index fund investors paid less tax (mostly from dividend income), despite their higher return.

John Bogle says about actively managed funds, ” Fund returns are devastated by costs, adverse fund selection, bad timings, taxes and inflation.”

chapter - 18 and 19: asset allocation

This chapter starts with a quote, “When you begin to invest. As you accumulate assets. When you retire.”

John Bogle went deep into strategic asset allocation required for next gen personal finance and retirement planning. A 1986 study by BHB established that, asset allocation explains 94% of differences in portfolio returns. Therefore, these two chapters are incredible for investors looking for retirement planning.

John Bogle introduced two fundamental factors :

1. Your ability to take risk

2. Your willingness to take risk

These two factors are considered gold standards in next-generation personal finance and wealth management. There are many common-sense examples in this chapter that are easy to understand, but investors,looking for retirement planning, should read them at least once and apply the principles in their lives.

chapter - 20: investment advice that meets the test of time

This chapter is like a compilation of all the golden investment rules in a crisp manner. (Read page – 260-261 thoroughly) Here are a few from them –

1. We must start to invest at the earliest and continue to put money away regularly from then on.

2. We know that costs matter overpoweringly in the long run, and we know that we must minimize them.

3. We know that taxes matter and they need to be minimized.

Finally, he adds, “While the interests of Wall Street’s businesses are well served by the aphorism “Don’t just stand there – do something!”, the interests of the Main Street investors are well served by an approach that is diametrical opposite: “Don’t do something – just stand there!”

This chapter is like The Little Book Of Common Sense Investing Summary itself. Don’t miss it! If possible, note them and keep them on your study or working table where you can read them daily.

Some Pitfalls

After going through The Little Book Of Common Sense Investing Summary, you would have realized that John Bogle has advised low-cost index fund investing is the only way for ordinary investors. However, such types of advice are mostly for defensive kind of investors. The Little Book Of Common Sense Investing doesn’t go deep into what an enterprising investor should do, like Benjamin Graham’s book, The Intelligent Investor does. It doesn’t explain why there is a Warren Buffet, Bill Gates, or Jeff Bezos on Wall Street that have made massive wealth over the years.

conclusion

The Little Book Of Common Sense Investing Summary is prepared to summarize John Bogle’s messages crisply to give enough insights to most investors for their next gen personal finance and retirement planning needs.

The Little Book Of Common Sense Investing is new compared to other investment classics like “The Intelligent Investor”. But it’s an advantage for John Bogle, as he has more data points, and he has taken full advantage of it. For example, when the first edition of “The Intelligent Investor” was written, the dividend yield on stocks usually remained above the bond yield. However, it changed afterward due to hyperinflationary situations, oil shocks, and many other factors. In the last 60 years (1947-2007), dividend yields never exceeded the interest rate on bonds. (page – 226)

Therefore, his advice of “Investing in low-cost index funds is the only way to guarantee your fair share of stock market returns” is the gold standard for most investors. Both Chapter 8 and Chapter 4 make the strongest argument in favor of low-cost index funds for the investor. While index investing allows one to sit back and let the market do the work, too many investors trade frantically, turning a winner’s game into a loser’s game. The Little Book of Common-Sense Investing Summary is prepared to act as a solid guidebook for financial freedom summarizing what the legendary investor has to say.

I did my best to cover as many points as possible in The Little Book of Common-Sense Investing Summary, but it is humanly impossible to cover all the details from such a timeless book. I would suggest you enjoy reading it at least once and I am sure you will not regret it.

“The Little Book of Common-Sense Investing Audiobook” is the audio version of “The Little Book of Common-Sense Investing”. The listening length is around 5 hours and 7 minutes, narrated by Thom Pinto. It is better to take notes while listening to the chapters. Do not rush through the chapters. Understanding the essence of the book is more important than racing against time to finish it. You may need to listen to it multiple times, so be patient and enjoy the experience.

The benefit of “The Little Book of Common-Sense Investing Audiobook” is, that you can enjoy listening to it while sitting inside the cab on your way to the office, and it does not take additional time to get the most valuable investment lessons in life.

The “The Little Book of Common-Sense Investing Audiobook“ is available for FREE on Amazon, with trial membership as of writing this review. The audiobook is also available in paperback, hardcover, and Kindle formats. If you are from India, you can go to Amazon (India), if you are from another country, you can go to Amazon (International) to check the price.

Let “The Little Book of Common-Sense Investing Audiobook” be part of your financial freedom book collections.