How Retail Traders are Losing Money in F&O and What They Can Learn

Readers like you help support Lifespectrum360.com. When you purchase using links on our site, we may earn an affiliate commission. Read More.

The Securities and Exchange Board of India (SEBI), which regulates the capital markets in India, recently conducted a comprehensive study on the trading behaviors of various market participants in the Futures and Options (F&O) segment. The goal was to identify potential risks and develop rules and regulations to minimize them, thereby maintaining trust in the capital markets and ensuring smooth operations. This type of study is part of SEBI’s regular efforts to evaluate market functioning.

Table of Contents

Key Findings of the Study

91% of Retail Traders Have Lost Money In F&O

Over the past few years, stock market-related YouTube channels have mushroomed in India. Many YouTubers showcase record profits by adopting certain trading strategies and encourage viewers to replicate these methods. They often present impressive numbers on screen, which creates a misleading impression of the actual risks involved.

As a result, the number of F&O retail traders has doubled from FY22 to FY24. However, this surge has not translated into the financial wellness of retail traders. According to the SEBI study, a staggering 91% of retail traders, roughly 7.3 million, reported trading losses in FY24.

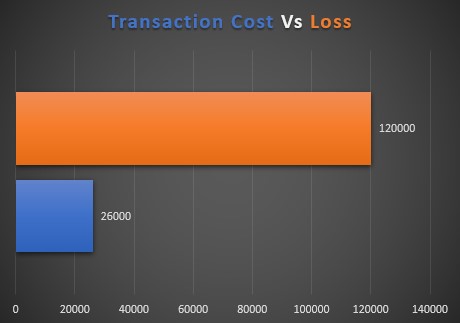

On Average An Individual Trader Lost ₹ 1,20,000 in F&O Trading

On average, each trader lost about ₹120,000 during the 2023-24 fiscal year, which is nearly 65% of per capita income. Such significant losses pose serious challenges for managing everyday expenses, including medical and educational costs. In fact, when faced with losing 65% of their earnings, many traders find it increasingly difficult to meet their household needs, often leading them into a debt trap.

The Low Brokerage Does Not Mean Less Cost For The Trader

Why are so many people excited about trading in F&O? They are offered to trade for as little as ₹10 in fees, which sounds great. This is called a decoy pricing strategy, where brokerage firms make F&O trading seem cheaper compared to other stock market investments.

However, the sad truth is that people often end up making many trades each day. They feel good about paying such a low fee for each trade but don’t realize that, on average, they end up spending about ₹26,000 a year. This is more than one-fifth of their total F&O trading losses. They miss the bigger picture.

Low Brokerage Attracts Retail Traders To Enter F&O Segment With Enthusiasm!!

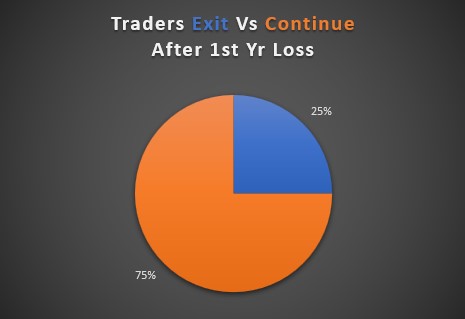

After losing a significant amount in the first year, it’s common for individuals to consider leaving trading. However, the number of repeat traders is surprising: 75% of traders continue to trade after losing money in their first year because they hope to recover their earlier losses. They watch more YouTube videos and subscribe to many new channels that keep popping up, each offering fresh trading tips.

Every time they watch a new video, they may feel foolish for not discovering that channel earlier. They believe that this time, they won’t make the same mistakes and will surely succeed with the new strategy. The low brokerage acts like the icing on the cake. So, they jump back in with renewed enthusiasm.

But The Enthusiasm Turns Bitter For The Traders!!

With newfound enthusiasm about their “gold mine” strategy, retail traders are hopeful about changing their fortunes. However, they don’t realize that thousands other traders also may be following the same strategy. Apart from other retail traders, there are super computers who build and execute such strategies at lightening speed.

Result: Retail traders’ situation worsens in the second year. Average trading losses have increased from ₹46,000 in case of traders in the first year compared to ₹144,667 in the second year.

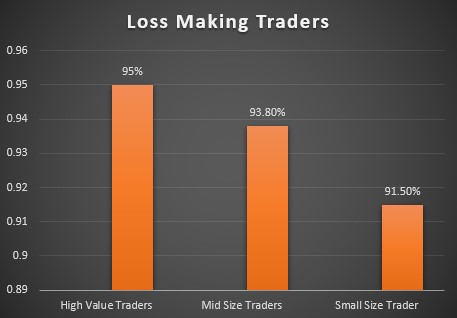

The Trader Who Showed More Enthusiasm Suffered Greater Losses

Some retail traders become so convinced by their new strategies that they achieve premium turnover of ₹10 million or more.

However, for every strategy, there is always a counter-strategy that they often overlook.

As a result, cumulative losses increase along with the trade value. 95% of high-value retail traders incur consistent losses, compared to 91.5% of smaller traders.

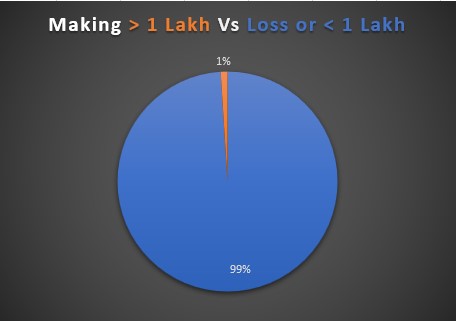

Result: 99% of Retail Traders Are Either Losing or Not Making Any Meaningful Profits

Without access to high-end technologies, retail traders spend a lot of time in studying and monitoring F&O trading. After all, they are hoping to earn some meaningful profits to take home. However, many traders are not seeing those profits.

In fact, 99% of traders are either losing money or not making any significant profits. Around 400,000 traders lost about ₹2.8 million on average. This amount can seriously impact the mental wellness of many traders.

There Is Only One Winner: The Algorithmic Trader!!

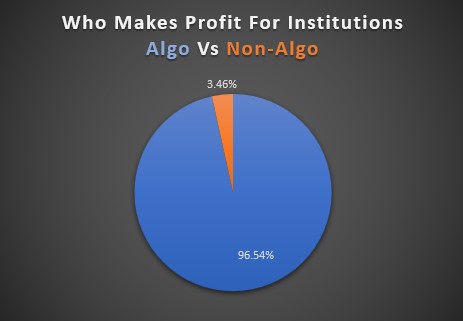

Institutional traders have gained in the expense of the losses to the individual traders. However, among the institutional traders, only 3.46% of profits are made by the non-algorithmic or non-algo trading entities. (Algorithmic trading is a method where a pre-programmed software tracks the market movements, analyses multiple factors like interest rates, exchange rates, oil prices, and political situations, and executes orders in real time.) So, strike rate of non-algo institutional traders is no better than individual retail traders.

96.54% of profits are made by algo trading institutions that use complex computer programs.

Unfortunately, individual traders cannot access these advanced algorithmic trading systems because they are very expensive. So, odds are completely against the retail traders to make a profit without these technologies.

Retail Traders in Top Cities Are Moving To Mutual Funds For Wealth Creation.

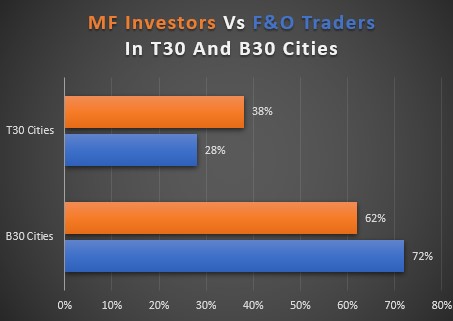

The top 30 cities (T30) are showing more mature behavior in investing, with 38% favoring mutual funds compared to only 28% in the beyond top 30 cities (B30).

However, B30 cities have a larger proportion of F&O retail traders, with 72% compared to 62% in T30 cities.

Will T30 cities reach at least 50% mutual fund investors while B30 cities try to catch up?

This change won’t happen overnight. In the meantime, will individual traders continue to incur heavy losses?

What Retail Traders Can Learn From The Study ?

-

F&O trading may not be suitable for all individual traders. These products can help manage risk in your stock portfolio, but they require a deep understanding and 5-10 years of experience in capital markets. Retail traders should be cautious when dealing with these products.

-

If you feel pressure from your friends to enter F&O trading, consider dedicating only a small amount of capital. If that capital is lost, it might be a sign to step away from F&O trading.

-

If you find yourself watching too many YouTube videos about options trading, it might be time to take a break. These videos often don’t contribute positively to your mental or financial well-being. If YouTubers are making millions from options trading, why would they share their secret strategies? Check the credentials of the YouTuber before believing anyone blindly.

-

In F&O trading, execution speed is crucial, which means you should be having access to advanced technology. If you don’t have access to tools like algorithmic trading, it’s better to avoid F&O trading.

-

Avoid borrowing money to trade in F&O. If you don’t have the capital to allocate for trading, it’s best not to engage in it. Borrowing for trading can lead to serious financial problems.

-

Keep these lessons in mind. They can help guide your trading decisions and promote better financial health.

Who will Take the First Step: The Regulator or Individuals?

SEBI is considering several actions, such as increasing the minimum lot size, adjusting upfront margin requirements, removing margin benefits for calendar spreads, reducing the number of option contracts per scrip, and increasing margins near expiry to protect the capital markets from collapsing. Additionally, it is developing an AI-based surveillance system to prevent fraudulent trading practices.

However, regardless of whether SEBI takes action, it’s important for you to be cautious about your financial wellness. You have put a lot of effort into earning your money, and it can be devastating to see losing the money without any benefits to you. Planning for financial wellness is not a luxury but a necessity. Your financial wellness will lead to a better overall life, your mental, physical and spiritual wellness.

If you or any of your friends are already involved in or considering entering F&O trading, we recommend reading two relevant articles: “Speed Thrills But Kills” and “Patience Is A Virtue.” Subscribe to our newsletter and join a fast-growing community of like-minded individuals to get the analysis you need for your financial wellness. We offer all the tools you need for your financial wellness as part of the Next Gen Personal Finance Solutions suite.

Let us know in the comments if you liked this article—your feedback matters!

Data sources: SEBI, Statista, Bloomberg, Reuters

Additional resources for financial wellness

Disclaimer: This article is the personal opinion of the author. The information in the article is generic and not tailored to specific situations of individuals. Therefore, the article is for informational purposes only and not intended to be personal financial advice or any kind of recommendation. Readers should understand that there is an inherent risk involved with financial decisions and should consult financial advisors for help with any investment advice. Neither the author nor Lifespectrum360.com is liable for the decisions readers make.

Birendra Sahu

Birendra is a seasoned finance professional with over two decades of expertise in the financial industry. He has experience in several multinational banks in both operations and technology. His areas of expertise are Investment Banking, Asset and Wealth Management, Treasury and Risk Management.

FAQ

Studies suggest that a significant portion of retail traders experience losses, with estimates indicating that around 90% of retail traders lose money overall. 99% of the retail traders cannot make money beyond 1,00,000 per year i.e. 8,250/- per month.

The statistic that 95% of traders lose money is frequently cited to emphasize the challenges in trading. Common reasons for these losses include a lack of education, insufficient risk management, emotional decision-making, and an inability to adapt swiftly to changing market conditions. Additionally, significant profits are often generated by algorithmic trading entities, which retail traders typically do not have access to.

Yes, many studies and surveys indicate that about 90% of retail traders may incur losses. This statistic reinforces the idea that trading is highly challenging and not as straightforward as it may seem. Success often requires significant knowledge, experience, a disciplined approach to risk management and access to high-end technologies like algorithmic trading..

Here are five common reasons traders may incur losses:

- Lack of Education: Many traders enter the market without a solid understanding of trading principles and strategies.

- Poor Risk Management: Failing to set stop-loss orders or allocate capital wisely can lead to significant losses.

- Emotional Decision-Making: Allowing emotions to dictate trading decisions often results in impulsive actions and poor outcomes.

- Inadequate Trading Plan: Trading without a well-defined strategy can lead to inconsistent results and increased risk.

- Market Volatility: Trading in the stock market often involves very thin margins. Traders who do not have access to high-end technologies, such as algorithmic trading, which allows for lightning-fast execution, can be caught off guard, leading to significant losses.

68 thoughts on “How Retail Traders are Losing Money in F&O and What They Can Learn”

Тайсон Ф’юрі виявив, що поразка від Усика стане його останнім боєм у кар’єрі.

estrategias sitios apuestas online (https://Trevoragency.com) deportivas

Про науку простими словами – цей сайт допоможе вам краще зрозуміти складні речі.

Deposit crypto, play instantly, withdraw instantly. No excuses, no waiting. Just pure stake login energy.

stake dice isn’t chasing trends — it sets them. Fastest growing crypto casino for a reason. Come see why.

Я готувалась до НМТ з математики, і цей гайд для батьків і учнів мені дуже допоміг.

Experience true luck at luckyland slots app! Sign up for your free welcome package: 7,777 Gold Coins and 10 Sweeps Coins. Enjoy sweepstakes fun with real cash redemptions!

Unlock endless entertainment with luckyland slots sign up bonus! Sign up and receive 7,777 free Gold Coins + 10 Sweeps Coins immediately. Play premium slots and cash out your Sweeps wins hassle-free!

sex

Різноманітність смаків з овочевими стравами допоможе зробити ваш раціон більш цікавим і здоровим.

que es un momio en mejor sitio de apuestas online

Usually I don’t learn article on blogs, however I would like to say that this write-up very compelled me to check out and do so! Your writing style has been amazed me. Thanks, quite great article.

https://bushrapfzu791741.blog-gold.com/56187396/sorry-but-i-m-not-able-to-fulfill-your-request

The geographic landscape of the Asphalt Shingles Roofing

Material Market highlights varied growth patterns across key

regions, influenced by differences in industrial maturity, technology adoption, and levels

of investment.

http://www.jfva.org/test/yybbs/yybbs.cgi?list=thread)

http://carlscorona.com

que es linea de gol comparativa Apuestas deportivas

https://www.carlscorona.com

Казки не тільки розважають, але й навчають. Ознайомтеся з чудовими казками для дітей на нашому сайті.

http://www.carlscorona.com

https://www.havananews.net/newsr/15854

vorhersagen sportwetten

Here is my webpage … Die besten wetten

online wettseiten

Here is my web-site – seriöse wettanbieter deutschland – Monica

–

indian porn

Very soon this web site will be famous amid all blog people, due to it’s pleasant

posts

online app wetten mit Freunden [43.206.224.239] test

https://litowof420.livejournal.com/43230.html

sportwetten tipps vorhersagen heute

Feel free to surf to my website – sichere wetten strategie; https://Betmarlocagrimerkezi.com/,

wettseiten vergleich

Here is my page – bester wettanbieter betrugstest

was bedeutet handicap beim wetten

my blog post; beste Wettanbieter ohne oasis

https://healingxchange.ning.com/forum/topics/c-digo-promocional-1xbet-cuba-2026-redluck

https://v-kosmose.com/gadanie-onlajn/

sportwetten schweiz steuern – Arlie

– live

beste online sportwetten mit paypal quoten

https://litowof420.livejournal.com/42895.html

Awesome, thanks!

live wetten mit gratis guthaben verbot

Для безопасной игры и получения бонусов посетите fugu casino официальный сайт вход.

Сайт использует защищённые протоколы для надежного проведения финансовых операций.

Feel the rush of starburst bonus right now. Expanding wild feature is the heart of the action. 96.09% RTP keeps it fair and thrilling.

https://md.coredump.ch/s/9VQKju4eX

Ищите добросовестного дистрибьютора автошин для автомобильного хозяйства, компании по перевозкам или торговых точек? Осуществляем выгодное сотрудничество с доставкой во все регионы России!

Почему выбирают нас?

• Большой выбор: Грузовые шины, легковые шины, сельскохозяйственные и индустриальные шины передовых производителей.

• Различные партии: занимаемся с крупным, средним и мелким оптом. Индивидуальные условия для клиентов.

• Доставка по территории РФ: грамотная транспортировка дает возможность нам в кратчайшие сроки и ответственностью осуществлять доставку во все населенные пункты.

• Прозрачные цены: Прямые поставки от изготовителя, следовательно даем наиболее низкие цены напрямую.

Не утрачивайте заработок вследствие нестабильности поставок с колесами! Обезопасьте вашу фирму надежной резиной своевременно.

Конкурентное предложение:

• Отсрочка оплаты

• Маркировка “Честный знак”

• Сертификаты ЕАС

• Сотрудничаем с частными и корпоративными клиентами

• Отчетность с НДС

Автошины оптом:

• Дальнемагистральные шины

• Региональные шины

• Шины для дорожно-строительной техники

• Индустриальные шины

• Шины для автобусов

• Карьерные шины

• Шины для легковых автомобилей

Выгодные цены https://asiancatalog.ru/cena

https://list-of-melbets-dandy-site.webflow.io/

https://dveri-ot-zavoda.ru/

The arguments in favor of marriage equality emphasize the importance of recognizing and protecting the rights of all couples, regardless of their sexual orientation . Marriage equality recognizes the diversity of human experience and relationships . The arguments against marriage equality highlight concerns about the impact of same-sex marriage on children and families.

semantics and word usage https://thediacritics.com/sandeep/humpty-dumpty-meaning-of-words/

deutschland ungarn wettquoten

My web page … sportwetten Seiten Bonus

мостбет регистрация бонус Киргизия mostbet84736.help

https://qpubhb.com/1xbet-promo-code-list-2026-1x200gift-bonus-e130/

besten wett Tipps tipps-heute

gewinner online wetten startguthaben (iranmartialarts.ir) dass

http://payt.phorum.pl/viewtopic.php?f=27&t=30360

музыка mailsco представляет собой универсальным способом выражения, поражающим многих.

питомник доберманов москва

https://strongcarkeychains.com/product-category/toyota/

1win приложение android 1win приложение android

This website contains a treasure trove of valuable information.

On this platform, you can find in-depth articles on various topics.

Materials available are extremely helpful for newcomers and professionals alike.

This place is a great resource for those seeking to learn their understanding.

https://somebububu.com/

online basketball wm 2023 wetten (https://basketball-wetten.com/) mit gratis startguthaben

mostbet казино слоты Кыргызстан mostbet84736.help

Для организации вашего события идеально подойдут контрольные браслеты на руку купить, которые обеспечат надежный контроль доступа и удобство для гостей.

Они используются для идентификации гостей и контроля доступа.

como activar codigo promocional 1xbet bono bienvenida

codigo promocional 1xbet 2026

codigo promocional 1xbet chile

codigo promocional 1xbet apuesta gratis

1xbet codigo promocional sin deposito

школа онлайн для детей shkola-onlajn13.ru .

получить короткую ссылку google seo-kejsy7.ru .

купить выпрямитель волос дайсон в москве купить выпрямитель волос дайсон в москве .

Wow, that’s what I was exploring for, what a information! existing here at this web site, thanks admin of this site.

Сервисный центр Dyson предлагает широкий спектр услуг по ремонту и обслуживанию устройств Dyson. Это связано с тем, что сервисный центр Dyson использует только оригинальные запчасти и имеет опытных специалистов, которые могут diagnosticровать и исправлять любые неисправности устройств Dyson. Сервисный центр Dyson имеет современное оборудование и технологии, которые позволяют ему предоставлять высококачественные услуги. Это делает сервисный центр Dyson идеальным местом для всех, кто ищет качественный и оперативный ремонт своих устройств Dyson. Сервисный центр Dyson также предлагает услуги по доставке и устройств Dyson.

Услуги сервисного центра Dyson

Сервисный центр Dyson имеет опытных специалистов, которые могут diagnosticровать и исправлять любые неисправности устройств Dyson. Это позволяет сервисному центру Dyson предоставлять высококачественные услуги и оперативно решать любые проблемы с устройствами Dyson. Сервисный центр Dyson работает с различными моделями устройств Dyson и может diagnosticровать и исправлять любые неисправности. Это связано с тем, что сервисный центр Dyson использует только оригинальные запчасти и имеет опытных специалистов, которые могут diagnosticровать и исправлять любые неисправности устройств Dyson. Сервисный центр Dyson предлагает широкий спектр услуг по ремонту и обслуживанию устройств Dyson.

Преимущества сервисного центра Dyson

Сервисный центр Dyson использует только оригинальные запчасти и имеет опытных специалистов, которые могут diagnosticровать и исправлять любые неисправности устройств Dyson. Это связано с тем, что сервисный центр Dyson имеет современное оборудование и технологии, которые позволяют ему предоставлять высококачественные услуги. Сервисный центр Dyson работает уже более 10 лет и имеет большой опыт в обслуживании устройств Dyson. Это делает сервисный центр Dyson идеальным местом для всех, кто ищет качественный и оперативный ремонт своих устройств Dyson. Сервисный центр Dyson использует только оригинальные запчасти и имеет опытных специалистов, которые могут diagnosticровать и исправлять любые неисправности устройств Dyson.

Заключение

Сервисный центр Dyson использует только оригинальные запчасти и имеет опытных специалистов, которые могут diagnosticровать и исправлять любые неисправности устройств Dyson. Это связано с тем, что сервисный центр Dyson имеет современное оборудование и технологии, которые позволяют ему предоставлять высококачественные услуги. Сервисный центр Dyson работает с различными платежными системами и предлагает удобные условия для клиентов. Это делает сервисный центр Dyson идеальным местом для всех, кто ищет качественный и оперативный ремонт своих устройств Dyson. Сервисный центр Dyson работает уже более 10 лет и имеет большой опыт в обслуживании устройств Dyson.

сервисный центр дайсон москва официальный https://dyson-servisnyj-centr-moskva.ru/