Who steals my MONEY ?

Readers like you help support Lifespectrum360.com. When you purchase using links on our site, we may earn an affiliate commission. Read More.

The article “Who Steals My Money” is based on the real-life experience of the author. While reading this article, think of yourself. You might have similar experiences in your life.

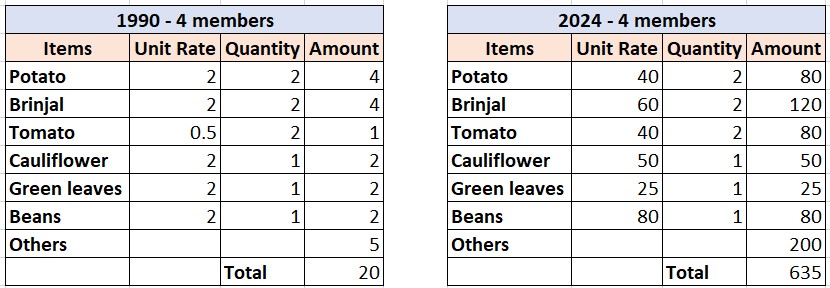

My father used to give me Rupees 10 /- to buy vegetables from the nearby market during my childhood days. This vegetable market used to happen twice a week. So, our weekly budget for vegetables for our 4-member family was Rupees 20/-. The weekly vegetable bill used to look like below. (See the Bill in the year 1990).

Fast forward, after almost 34 years, my vegetable bill looks like the one shown below for year 2024. (In the current bill, I have included only those items that I used to purchase in my childhood.)

The current vegetable bill is more than 31 times than 34 years back, i.e. 18.5% CAGR (compounded annual growth rate). In my area, Land prices, Educational and medical costs have increased at a faster rate than vegetable prices, each has increased by at least 100 times in the last 30-odd years.

If you had started saving through Bank fixed deposits and rolling them over every ten years, probably your savings would have grown by 15-16 times. (In the 1990s, the interest rate was around 12-13% in fixed deposits, which is 6-7% now.)

In other words, if you believe in savings through fixed deposits, you have been robbed in the last 30 years. You may look like a pauper now, even though you enjoyed a royal life when you started saving money!!

Who robbed you? The first term that comes to my mind, your mind, and everyone else’s is INFLATION!!

But I would say, the term INFLATION is just a mask. The real thief is someone else.

Then, who steals my money?

The answer is Excessive Money Printing!!

Let me explain what is Money Printing in simple terms.

Every central bank has the authority to print currency notes so that people can buy goods and services by exchanging the currency notes. These notes undergo regular wear and tear. Central banks print new notes to replace the old notes. But then, why will this money printing cause a massive price increase?

No. We are not talking about the money printing done to replace old and damaged notes.

Central Banks print huge amounts of money when they assess a crisis in the economy. They print money and supply it to the market through Banks, which reaches the public like you and me. Usually, such money comes at ultra-low interest rates. You would have seen, at certain times, interest rates come down drastically. We borrow money at cheap rates and spend. However, the excessive money chases the same goods and services, and their prices shoot uncontrollably. This phase is called hyperinflation.

To give a perspective, here are some facts –

FED printed around $ 13 Trillion during the recent COVID period, which is about 50% of US GDP of $ 23 Trillion in 2021. In simple terms, if the shopkeeper used to get one buyer earlier for a product, now he will get an additional buyer with plenty of additional printed money. Since there are more buyers for the same product, he has to jack up the price, sell to the top bidder, and get maximum revenue and margin. Both buyers need to quote higher prices if they need that product. In turn, these buyers will seek higher prices for their services to compensate for the increase in expenses. Thus, the vicious cycle of price increases starts. This phenomenon happened in the post-COVID period. US inflation numbers shot up to more than 9% quickly.

Money printing is not limited to the US alone. UK printed close to GBP 412 Billion between March 2020 and July 2021, which is close to 19% of total UK GDP of around GBP 2176 Billion. Similarly, the Eurozone also printed money close to EUR 1.85 Trillion. Japan printed close to YEN 70 Trillion ( USD 650 Billion, at 2020’s exchange rate of around 110 ), almost 13% of Japan’s economy.

why governments resort to money printing even if it harms the poor?

Before jumping into why governments cannot stop money printing, we should understand why people suffer because of money printing. We saw how money printing hits the savers badly, and the value of their savings decreases. But is it the same for the lower and middle-income groups?

Usually, lower and middle-income group people depend on daily/ monthly/ annual wages. We have seen that money printing helps hyperinflationary phases and how lower and middle-income group people seek increases in their wages to cover their expenses. However, the increases in wages don’t match the inflation rate post-money printing because of various factors. E.g. new members join the workforce almost every year. So, there will be competition among the employees for the same jobs. This competition caps the increase in salaries. It’s not always possible that the employer will be able to match the increase in salary with the inflation rate. To keep things in perspective, entry-level jobs in Tata Consultancy Services (TCS), one of the leading Indian IT services providers, have had the same salary range for the last few decades. Even though the cost of living has skyrocketed, the salary is stagnant.

Then why governments resort to money printing even though all governments claim they are pro poor and pro lower and middle income people?

The answer is that governments lack the choices!! When economic recessions come, the only agenda governments will have is to bring the economic situation back to normal. The options before the government are –

1. Increase the tax rates – Individuals or Corporations? If the government increases taxes on corporations, there is a possibility that companies will leave the country, and the country will suffer from a lack of enterprises, which will lead to massive unemployment.

Governments try to increase taxes on individuals, but this option needs to be exercised with caution. If taxes on individuals are raised substantially, people will have little or no money to spend, which will damage the economy.

2. Increase in tax net – This is one of the best options provided the country is an emerging economy and systems are inefficient. Many people are outside the tax net, and bringing them under the tax net boosts government revenue. However, the task is not as easy as it looks. A country has to improve its financial transaction reporting system to increase the tax net. This process cannot happen in days, weeks, or months. The countries need a few years of proper planning to implement such a system. So, when economies are in recession, the not-so-developed countries cannot implement this method immediately. Developed countries will have a limited scope for increasing the tax net. E.g. In the US, around 60% of people are paying income tax. This number is already very high. So, the chances of further increasing the number of tax-paying people are limited.

3. Use the surplus reserves – If a country has surplus reserves, then governments can spend on building infrastructure that can restart the economy. However, in today’s world, hardly any country has surplus reserves. Except for a few Gulf countries that have surpluses because of oil money, most countries around the world are in debt. The US has a debt of around $34 Trillion (more than the size of the economy). UK has a GBP 2.65 Trillion of national debt, which is almost equal to the size of the UK’s economy. When countries are deep in debt, the chances of using surplus reserves are ruled out.

4. Borrow more money to spend – Countries can borrow money from the market to increase spending on infrastructure activities so that, the economy can restart. However, this would mean interest rates rise when governments borrow money from the market. Implementation of this option has multiple challenges. First, it increases the government’s debt levels to an unmanageable extent. Second, when interest rates rise, servicing those debts becomes super expensive. Third, it reduces private borrowing because of the increase in interest rates. Reduction in private borrowings will not help the economy.

5. Ask the central bank to print more money – This option doesn’t come with any obligation to pay back to anyone. Here, the country’s central bank is printing, and the government has no definitive obligation to pay back. It doesn’t increase interest rates immediately. Rather, central banks lend this excess money at the lowest interest rate. People can borrow easily and spend. In the current fiat money system, central banks can print unlimited money. So, this option is the easiest for all countries to fall back on. However, a government should evaluate all other options before money-printing.

How to safeguard against money printing?

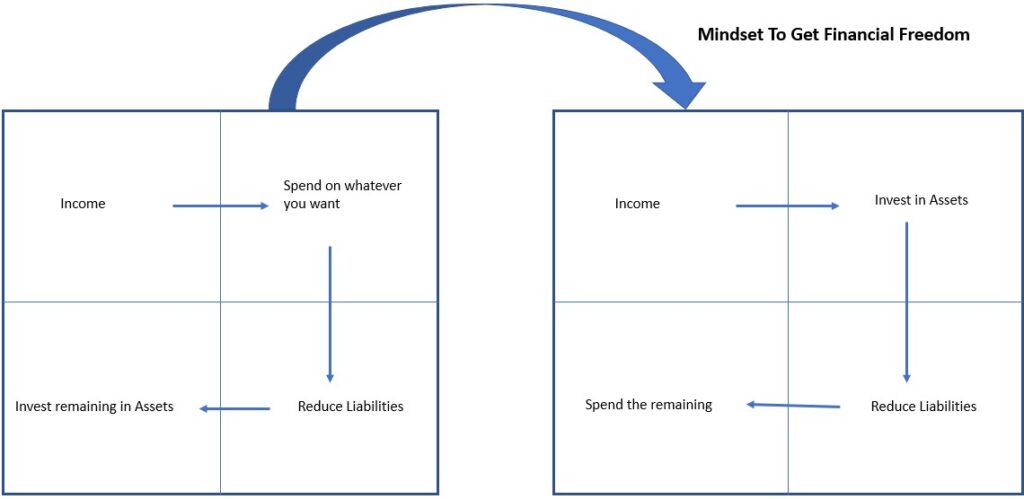

Invest in assets that will give you regular income and appreciate in value.

Since money printing is the easiest option governments and central banks can take, this will happen repeatedly. So, people should prepare themselves against hyperinflation due to excessive money printing.

The best way is to hold non-cash assets. Investing in cash or cash equivalents like fixed deposits should be limited to meeting sudden unforeseen events like job losses and medical emergencies. Individuals should invest in assets like equities, gold, and real estate, whose value is going to appreciate as money printing increases. Take the help of a trustworthy financial advisor, who will help you identify the assets where you should invest.

Never borrow for your spending on the show-off items. This habit limits your capacity to invest. Try a budget calculator to monitor your spending and investment objectives. Always try to invest money in growth assets that will earn money for you. E.g. if you invest in a company’s shares, the company management works for you to give you a dividend. So, over a few-year period, their dividends will help you manage your expenses. Also, because of hyperinflation, their prices will increase, and eventually, you will earn a good return on your capital.

fAQ on who steals my money?

Inflation is the rate at which the general level of prices for goods and services rises, eroding the purchasing power of money. In simpler terms, it means that over time, your money buys less than it used to.

Inflation reduces the real value of your savings. Even if the amount in your savings account stays the same, its purchasing power decreases because prices for goods and services increase over time.

Inflation is called a ‘silent thief’ because it gradually erodes the value of your money without you noticing it immediately. Typically, a small inflation is manageable. However, when central banks print excessive money, inflation becomes uncontrolled. This phase is often termed hyperinflation. It doesn’t create a visible reduction in your account balance, but hyperinflation diminishes your savings’ worth quietly. Like the vegetable example given at the beginning, you need to pay a lot of extra amounts to buy the same quantities of products because of inflation due to money printing. If you ask yourself “Who steals my money?”, you will realize the silent thief is none other than the inflation due to excessive money printing.

Often, savings interest rates do not keep pace with inflation. If the inflation rate is higher than the interest rate on your savings account, the real value of your savings will decrease over time.

Yes, consulting a financial advisor can be beneficial. They can provide personalized advice on protecting your savings from inflation and help you develop a comprehensive financial strategy that considers current and future inflation trends.

This article is the opinion of the author. The information in the article is generic and not tailored to specific situations of individuals. Therefore, the article is for informational purposes only and not intended to be personal financial advice. Readers should understand that there is an inherent risk involved with financial decisions and should consult financial advisors for help with any investment advice. Neither the author nor Lifespectrum360.com is liable for decisions readers make.

If you have suggestions about the article “Who Steals My Money,” please write us at contact@lifespectrum360.com.

Birendra Sahu

Birendra is a seasoned finance professional with over two decades of expertise in the financial industry. He has experience in several multinational banks in both operations and technology. His areas of expertise are Investment Banking, Asset and Wealth Management, Treasury and Risk Management.