patience is a virtue:

your gateway to serious wealth

Readers like you help support Lifespectrum360.com. When you purchase using links on our site, we may earn an affiliate commission. Read More.

patience is a virtue, but it's in short supply

In the previous article, “Speed Thrills But Kills“, we discussed that an investor should be cautious before jumping into share trading in futures and options. Even if they want to do so, they should have a separate trading account with limited capital. If they lose, get out of the trading and instruct your brain that trading is not for you. Then the question is, what should investors do?

The answer lies in an age-old saying, “Patience is a virtue.” Its roots can be traced back to biblical wisdom. Book of Proverbs 16:32 mentions, “Better a patient person than a warrior, one with self-control than one who takes a city.” This profound message highlights the immense value of patience, not just in our daily lives but also in our financial pursuits.

Consider a honey bee. It tirelessly works and gathers nectar, bit by bit, day after day. The bee’s unwavering patience and persistence eventually result in a rich, abundant honeycomb. Honey bees collect nectar from around two million flowers for one pound of honey.

Similarly, in the investment world also, long-term commitment and the gradual accumulation of wealth are crucial to achieving financial success. Patience and a disciplined approach to investing, open the door to financial stability and growth, allowing wealth to flourish over time.

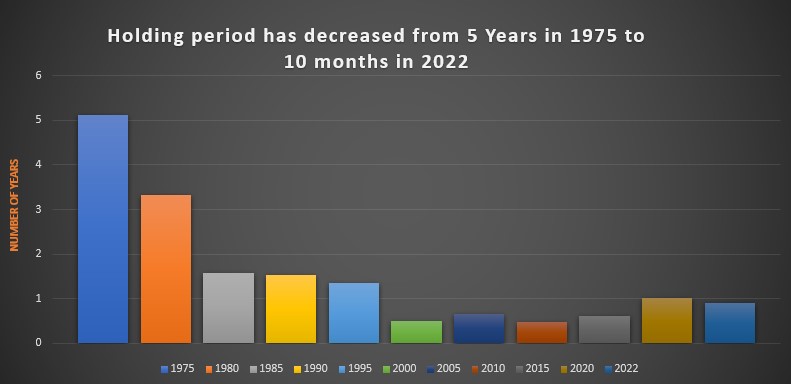

However, the data suggests that patience is evaporating from investors.

The average period for holding onto a stock in the US has decreased from over five years to less than a year(around just ten months) in 2022 (Source: WorldBank). There are two main reasons for this. There are two main reasons for it.

1. People typically sell stocks in December to book capital losses that they can set off against other business income.

2. People are getting uncomfortable with holding onto the uncertainty in stock returns.

If people are selling stocks for the first reason, they will buy them in January of the following year, which means their selling and buying are merely technical.

However, if the reason is second, then there is no remedy. Warren Buffet, the famous investor, once said, ” If you don’t want to hold the stock for ten years, then don’t hold it for even ten minutes.” Even then, there is a short supply of patience among the investors.

People are more sensitive to loss rather than equal gain

What prevents people from not having patience with their investment? Risk aversion. People will be ready to pay Rs 1500.00 or $ 20.00 for a pizza party, but if someone asks to buy and hold 2 State Bank of India (SBIN) shares, people will say it’s risky. Our brain responds to losses with double the intensity than gains. At a pizza party, people know they will surely get instant gratification. However, when it comes to holding an equity share, people feel that they may lose the money. So, they respond fiercely not to hold onto the equity shares. Their commitment to long-term investment in equity shares becomes contingent upon an assurance that the return on the equity investment should be ‘x’ %.

Is it rational to expect a guaranteed return on equity investment?

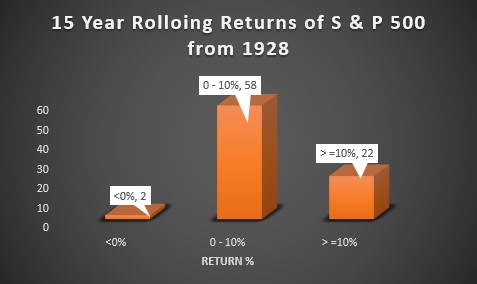

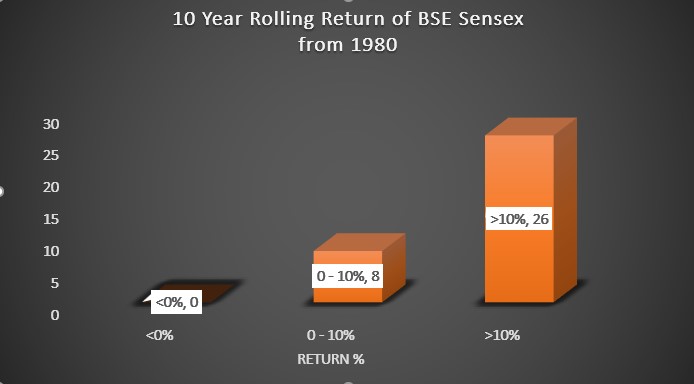

On a long term, stock markets losses are virtually nil

As per the data for two of the world’s most popular indices, S& P 500 (source: Nasdaq) has virtually not made any losses(only losses on two occasions) since 1928, if the holding period is 15 years. Similarly, the Bombay Stock Exchange, India (source: BSE, India) has also not made any losses since 1980 if the holding period is 10 years. These two graphs highlight the importance of patience in investing. Patience is a virtue of value investing. “Patience is the key to success, but unfortunately, patience is in short supply. If you have this, the market will reward you handsomely.” famous investor Benjamin Graham mentions in his book “The Intelligent Investor“.

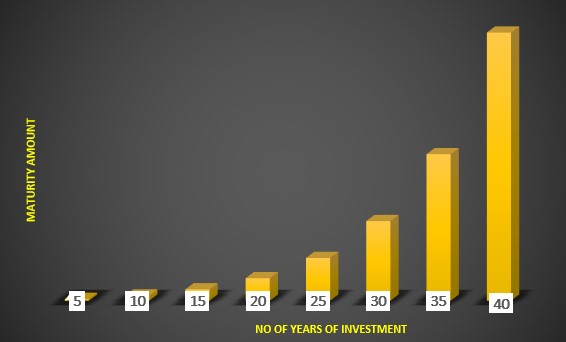

serious wealth is made in the later stages of accumulation

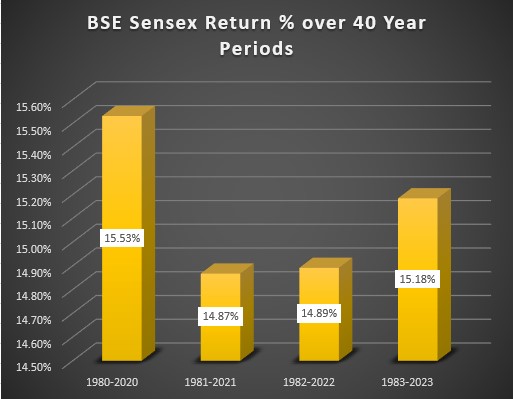

Once you build a sizable amount in the first 10 years, you will see serious wealth accumulated. As the number of years increases, your treasury only grows at a disproportionately larger rate. If a person starts investing at the age of 20, which is the starting age of earnings for most individuals, and stays invested till 60 years, the retirement age for most people, the retirement kitty will grow to Rs 11.4 Crore. (Assumed rate of return 12%, Sensex has given at least 14.8% over 40-year periods since 1980). You should look at a Compound Interest Calculator that can give data in a tabular form for different periods, and you can see for yourself how much wealth you can accumulate as you give time to your wealth kitty.

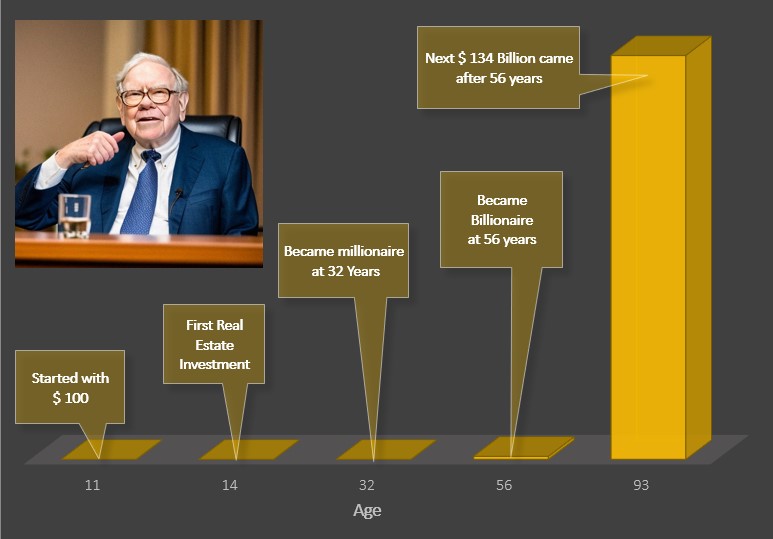

Warren buffet earned majority of wealth after he crossed 56

Warren Buffet started the investment journey when he was 11 years old with just $100.00.

He made his first real estate investment at the age of 14, and he had only $5,000.

Became a millionaire at the age of 32 Years, i.e. 21 years after starting his investment journey.

Became a billionaire at the age of 56 Years, i.e. 45 years after starting his investment journey.

The next $134 billion of his fortune has come after he crossed 56 years of age!!

His life’s mantra is – Start early and stay for long. It’s simple to understand but requires a lot of patience to execute.

As you give more time to your investment, the short-term fluctuations fade out, and you will reap the benefits of the power of compounding. If you want to build serious wealth, you should have patience and nurture your investments like you are growing a banyan tree. There will be rough weather, storms, and extreme summer when your plant may die. But if you are determined, you take care of the plant in every single season, year after year. The small plant takes time to grow and becomes a big banyan tree, but when it grows, it stays for a long time and gives plenty of oxygen and shade than any other plant.

Similarly, in your investment journey, there will be a lot of ups and downs also known as market noises. Take the help of a financial advisor, review your portfolio once a year or as recommended by your financial advisor, and stay the course for a long term. Remember, “The only place where success comes before work is in the dictionary.” – Vidal Sassoon. There is no shortcut to build wealth. Patience is a virtue that will be your gateway to serious wealth creation.

If you want to get all our articles and tools on Financial Freedom, visit our Next Gen Personal Finance page and sign up. The next time, an article is published, it will be delivered to your mailbox directly.

If you have any suggestions on the article “Patience is a Virtue: Your Gateway to Serious Wealth ”, feel free to drop them at contact@lifespectrum360.com. If you are an expert in the finance domain and want to write guest posts for us, please reach out to us at lifespectrum360@gmail.com.

Disclaimer: This article is the personal opinion of the author. The information in the article is generic and not tailored to specific situations of individuals. Therefore, the article is for informational purposes only and not intended to be personal financial advice or any kind of recommendation. Readers should understand that there is an inherent risk involved with financial decisions and should consult financial advisors for help with any investment advice. Neither the author nor Lifespectrum360.com is liable for the decisions readers make.

Birendra Sahu

Birendra is a seasoned finance professional with over two decades of expertise in the financial industry. He has experience in several multinational banks in both operations and technology. His areas of expertise are Investment Banking, Asset and Wealth Management, Treasury and Risk Management. You can reach out to him on Linkedin. (https://www.linkedin.com/in/birendrasahufrm/)

FAQ

“Patience is a Virtue” emphasizes the importance of being patient when it comes to building wealth. It means that achieving significant financial success often requires a long-term perspective, consistent effort, and the ability to wait for investments and financial decisions to mature.

Patience is crucial because most wealth-building strategies, such as investing in stocks, real estate, or starting a business, take time to yield substantial returns. Quick fixes or short-term strategies often lead to higher risks and potential losses.

- Set Long-Term Goals: Define your financial goals for the next 5, 10, or 20 years.

- Educate Yourself: Understand the principles of investing and wealth-building.

- Stay Disciplined: Stick to your investment plan and avoid impulsive decisions.

- Monitor Progress: Regularly review your financial progress without making hasty changes.

Compounding involves earning returns on both your initial investment and the accumulated returns over time. The longer you keep your money invested, the more powerful compounding becomes, significantly boosting your wealth in the long run.

While patience is generally beneficial, it’s important to periodically review and adjust your financial strategies. Sticking to a failing investment or not diversifying can be harmful. Balance patience with informed decision-making and adaptability. Consult a financial advisor whom you can trust for such periodic reviews.

Patience is a virtue. Like other virtues, a positive and disciplined mindset is key to maintaining patience. Stay focused on your long-term goals, avoid distractions from market volatility or short-term setbacks, and keep a calm and steady approach to your financial decisions.

- Visualize Success: Regularly remind yourself of your financial goals and what achieving them means for your future.

- Celebrate Milestones: Acknowledge and reward yourself for reaching smaller financial milestones along the way.

- Stay Informed: Keep learning about financial strategies and market trends to stay engaged and motivated.

- Avoid Impulse Decisions: Don’t make investment decisions based on short-term market movements or emotions.

- Steer Clear of Get-Rich-Quick Schemes: Be wary of strategies that promise quick and easy wealth.

- Ignore Unnecessary Noise: Focus on your long-term plan and avoid being swayed by negative news or opinions.

Successful investors like Warren Buffett emphasize the importance of patience. They invest in high-quality assets, hold them for the long term, and resist the urge to sell based on short-term market fluctuations.

Remember, patience in wealth building isn’t about waiting passively but about taking consistent, informed actions over time to achieve financial success.