Readers like you help support Lifespectrum360.com. When you purchase using links on our site, we may earn an affiliate commission. Read More.

what are Three ways you can harness the power of compounding for a secured retirement life

In the world of finance, “power of compounding” is often hailed as the eighth wonder. There used to be a chess-board artist who made a fortune by using the power of compounding. It is a super power that can transform even modest investments into substantial wealth over time. Understanding the compounding formula and the key variables involved — investment amount, time period, and rate of return — is essential for anyone seeking for financial freedom. In this article, we will explore what are three ways you can harness the power of compounding.

Table of Contents

The Compounding Formula

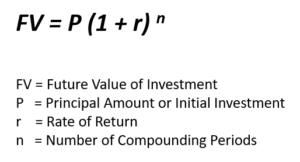

The compounding formula is elegantly simple yet tremendously impactful. At its core, it can be expressed as:

Here, the principal amount represents the initial investment, the rate of return is the annual interest rate, and the number of compounding periods signifies the time the investment is held. If you have fully understood these three things, you will have an answer to “What are three ways you can harness the power of compounding?’.

As mentioned, the formula is simple, and you would have known it. But you should see, how impactful this simple-looking formula is!! You can check our compound interest calculator to calculate the maturity amount with different combinations of initial investment, rate of interest and time.

Importance of Investment Amount

If someone asks “what are three ways you can harness the power of compounding?”, the first thing comes to our mind is how much more we can invest. This is known as investment amount, or principal and it’s the foundation of magical compounding. The larger the principal amount, the greater the potential for growth.

Consider two scenarios: one where an individual invests $1,000 and another where the investment is $10,000. Assuming the same rate of return and time period, the $10,000 investment will yield a substantially higher future value due to the compounding effect.

Increasing your investment amount not only augments the starting point for compounding but also multiplies the gains over time. It provides a solid base for exponential growth and is a pivotal factor in wealth accumulation.

Importance of Time Period

Time is a critical element in the compounding equation. The longer an investment is allowed to grow, the more pronounced the compounding effect becomes. Let’s illustrate this with an example:

Consider an investment of $5,000 with an annual rate of return of 8%. If left to grow for 10 years, the future value would be calculated as $5,000 \times (1 + 0.08)^{10}, resulting in a certain sum. Now, if the same investment is held for 20 years, the compounding effect will be more pronounced, leading to a significantly higher future value.

This highlights the importance of patience in wealth-building. Time is an investor’s ally, and harnessing the power of compounding requires a long-term perspective. Even small investments, given enough time, can blossom into substantial wealth.

Importance of Rate of Return

While both the investment amount and time period are crucial, the rate of return adds a dynamic element to the compounding formula. A higher rate of return accelerates the growth of the investment exponentially. Let’s examine this with a hypothetical scenario:

Assume an initial investment of $2,000. At a 5% annual rate of return, the future value after 15 years would be calculated as $2,000 \times (1 + 0.05)^{15}. Now, if the rate of return is increased to 10%, the future value will be significantly higher.

The rate of return not only amplifies gains but also compensates for inflation and other economic factors. However, it’s essential to maintain the right balance between high returns with the associated risks. Prudent investment decisions require careful consideration of risk tolerance and diversification.

Impact of Changing Variables

Changing any one of the three variables in the compounding formula — investment amount, time period, or rate of return — has a profound impact on the final sum. Let’s explore how adjustments to each variable influence the outcome:

- Adjusting Investment Amount: Increasing the initial investment amount directly increases the principal in the compounding formula. This, in turn, results in a higher future value. Conversely, decreasing the investment amount has the opposite effect. The key takeaway is that a larger principal sets the stage for more substantial wealth accumulation.

- Extending The Holding Period: The impact of time on compounding is remarkable. Extending the holding period allows the compounding effect to work over a more extended time frame, leading to exponential growth. Conversely, reducing the time period limits the potential for compounding to unfold fully. Investors are encouraged to adopt a patient and long-term perspective for optimal results.

- Adjusting Rate of Return: A higher rate of return turbocharges the compounding process, leading to accelerated growth. However, this comes with increased risk. On the other hand, a lower rate of return may result in slower growth but is often associated with lower risk. Striking the right balance between risk and return is crucial for sustainable and resilient wealth building.

Key Takeaway

In the journey towards financial prosperity, harnessing the power of compounding is a strategic imperative. By understanding the compounding formula and the pivotal role of investment amount, time period, and rate of return, investors can make informed decisions to maximize their wealth potential.

The key takeaway is clear: start early, invest consistently, and embrace a long-term perspective. By increasing your investment amount, extending your time horizon, and carefully considering the rate of return, you can unlock the full potential of compounding and pave the way for a financially secure future.

In conclusion, you would have got an answer to the question we asked at the beginning – “what are three ways you can harness the power of compounding” .

The magic of compounding lies in its ability to turn time, modest investments, and a reasonable rate of return into a formidable force for wealth creation. Whether you’re a novice investor or a seasoned financial guru, harnessing the power of compounding is a timeless strategy that transcends market fluctuations and economic uncertainties.

In the journey towards financial prosperity, harnessing the power of compounding is a strategic imperative. By understanding the compounding formula and the pivotal role of investment amount, time period, and rate of return, investors can make informed decisions to maximize their wealth potential.